- The Pound Sterling corrected briefly from nearly four-year highs against the US Dollar.

- GBP/USD traders look to Fed Minutes and UK GDP data amid trade and fiscal concerns.

- Technically, GBP/USD retains upward bias so long as the daily RSI stays bullish.

The Pound Sterling (GBP) stretched its recovery mode and hit its highest since October 2021 against the US Dollar (USD) before sellers jumped in and sent the GBP/USD pair back toward the 1.3650 region.

Pound Sterling buyers faced exhaustion

After a stellar performance, spanning almost two weeks, GBP/USD buyers took a breather as exhaustion set in.

The main driver again was the dynamics of the US Dollar, but the British bond market jitters were also felt midweek, undermining the recent bullish momentum in the currency pair.

Concerns over US President Donald Trump’s ‘big, beautiful’ tax-cut and spending bill remained a major drag on the Greenback alongside uncertainty over potential US trade deals ahead of the July 9 tariff deadline.

Markets remained wary over a $3.3 trillion addition to the national debt, after the spending bill was passed by the US Senate on Tuesday and later narrowly approved by the Republican-controlled House of Representatives on Thursday,

On the trade front, the United States (US) and Vietnam reached a trade agreement on Wednesday. However, concerns about the US trade deals with Japan, South Korea, and the European Union (EU) kept the Greenback’s downside potential intact.

These worrying factors outweighed any positive impact on the buck from strong US JOLT Job Openings and ISM Manufacturing PMI data.

Further, investors pondered the timing of the next interest rate move, following Federal Reserve (Fed) Chairman Jerome Powell’s speech at the European Central Bank (ECB) Forum on central banking in Sintra on Tuesday.

Powell stuck to the bank’s ‘data-dependent’ rhetoric but said that “I wouldn’t take any meeting off the table. Can’t say if July is too soon to cut rates, will depend on data.”

The persistent downbeat mood around the Greenback drove the GBP/USD pair to nearly four-year highs of 1.3789.

However, Pound Sterling sellers quickly jumped in due to resurfacing concerns regarding the British fiscal and political situation, which sent the UK gilts in a downward spiral and GBP/USD to weekly lows of 1.3563 on Wednesday.

British Finance Minister Rachel Reeves appeared visibly upset during PMQs on Wednesday after Prime Minister Keir Starmer avoided a question if she would remain in her position until the next election.

Although Starmer’s press secretary later said that “the chancellor is going nowhere, she has the prime minister’s full backing.”

The Pound Sterling shrugged off that comment and sustained its corrective decline as the USD witnessed a relief rally on a surprisingly strong US labor market report on Thursday.

The headline Nonfarm Payrolls (NFP) rose by 147,000 in June, against expectations of a 110,000 increase and the previous revision of 144,000. The Unemployment Rate unexpectedly dropped to 4.1% last month, versus 4.3% expected and May’s 4.2%.

Solid job gains poured cold water on increased bets of US Federal Reserve (Fed) aggressive interest rate cuts this year, making the case for the Fed to hold rates steady.

The USD rebound appeared temporary on lingering concerns over deepening America’s fiscal imbalances and tariffs, keeping the downside limited for the major.

Trump said late Thursday that he “will begin sending letters on trade tariffs starting Friday.”

Week ahead: Fed Minutes and UK GDP on tap

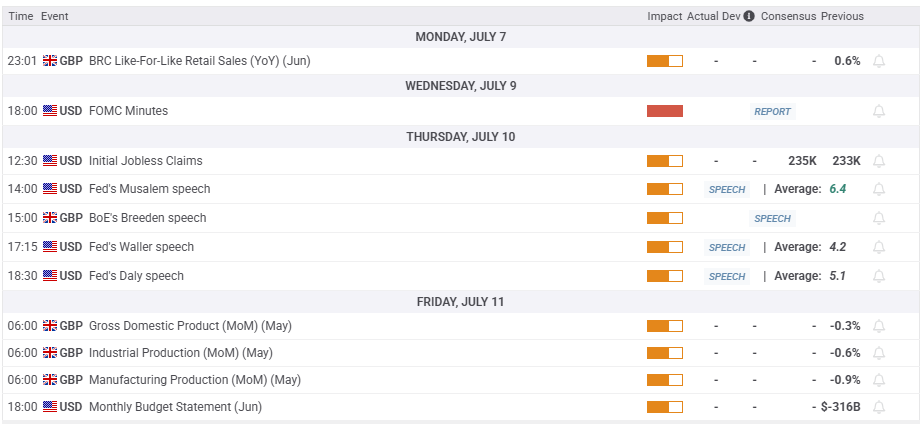

Following an action-packed week, Pound Sterling traders look forward to a relatively light week in terms of top-tier economic data releases.

The early part of the week is devoid of any significant macro data and hence, the focus will remain on the potential US trade deals as the July 9 deadline approaches.

Also, of note will be the UK bond market action.

On Wednesday, the Minutes of the Fed’s June meeting will steal the spotlight, with investors still scouting for hints on the timing of the next Fed rate cut.

Thursday will feature the usual weekly Jobless Claims from the US, as well as speeches from St. Louis Fed President Alberto Musalem and BoE Deputy Governor Sarah Breeden.

The UK monthly Gross Domestic Product (GDP) report will be published on Friday alongside the Industrial and Manufacturing Production data. The US calendar that day holds only the Federal Budget Balance of relevance.

GBP/USD: Technical Outlook

GBP/USD is battling the previous resistance-turned-support of the February 2022 high at 1.3643 following a rejection above 1.3750 on several occasions.

Despite the retreat, buyers have managed to defend the 21-day Simple Moving Average (SMA) support at 1.3588 as the 14-day Relative Strength Index (RSI) continues to stay firm above the midline, currently near 57.

Therefore, sustaining above the 21-day SMA on a weekly closing basis is critical for the resumption of the GBP/USD rally.

On the upside, the immediate hurdle is seen at the 1.3750 psychological level, above which a test of the 1.3800 round level will be inevitable.

Buyers will then target the static resistance around 1.3875 on their way to the July 30 high of 1.3983.

Should the corrective downside gain traction, the 21-day SMA at 1.3588 will be the first line of defense for buyers.

Additional declines will likely attack the 1.3445 demand zone, which is the confluence of the April 28 high and the 50-day SMA.

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data.

Its key trading pairs are GBP/USD, also known as ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates.

When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money.

When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP.

A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period.

If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.