As we continue to track catastrophe bond market activity through this very busy 2025, total settled issuance analysed by Artemis has already surpassed $15 billion, while the outstanding cat bond market has grown by 15.5% since the end of last year. Catastrophe bond issuance is breaking all records so far in 2025, with now $15.025 billion of offerings settled across Rule 144A cat bonds and the few privately placed deals we have tracked.

Catastrophe bond issuance is breaking all records so far in 2025, with now $15.025 billion of offerings settled across Rule 144A cat bonds and the few privately placed deals we have tracked.

Impressively, the level of issuance now settled in 2025 has already broken the record for first-eleven month issuance. Meaning, in every previous year the catastrophe bond market has existed, we hadn’t ever seen that volume of deals settle between January and the end of November.

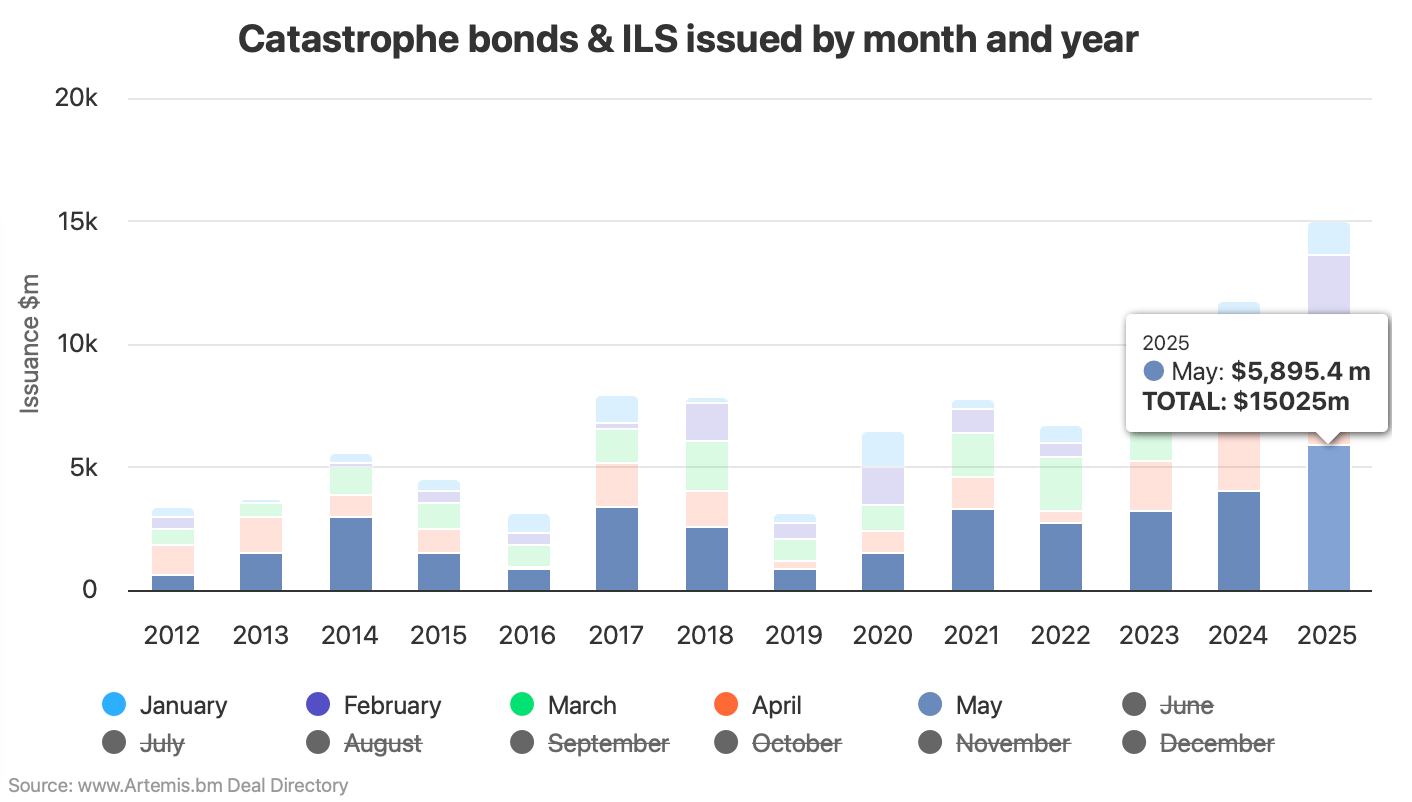

Given we are still at the end of May, with a whole month to run until the middle of 2025, it’s clear the first-half cat bond issuance record is being broken by a particularly significant margin.

The previous record for first-half cat bond issuance came in 2024, when just over $12.6 billion of deals were tracked by Artemis.

The chart below shows just how far ahead we are already, with only five months of 2025 almost run. You can analyse this interactive chart by deselecting months from the bottom of it, so you can analyse issuance by month, quarter, half-year etc.

Cat bond issuance settled in the month of May has reached a significant record high of almost $5.9 billion in 2025. Which beats the previous record for the month by approaching $2 billion.

It also makes May 2025 the biggest single month of catastrophe bond issuance in the market’s history, another very notable record that has been soundly broken this year.

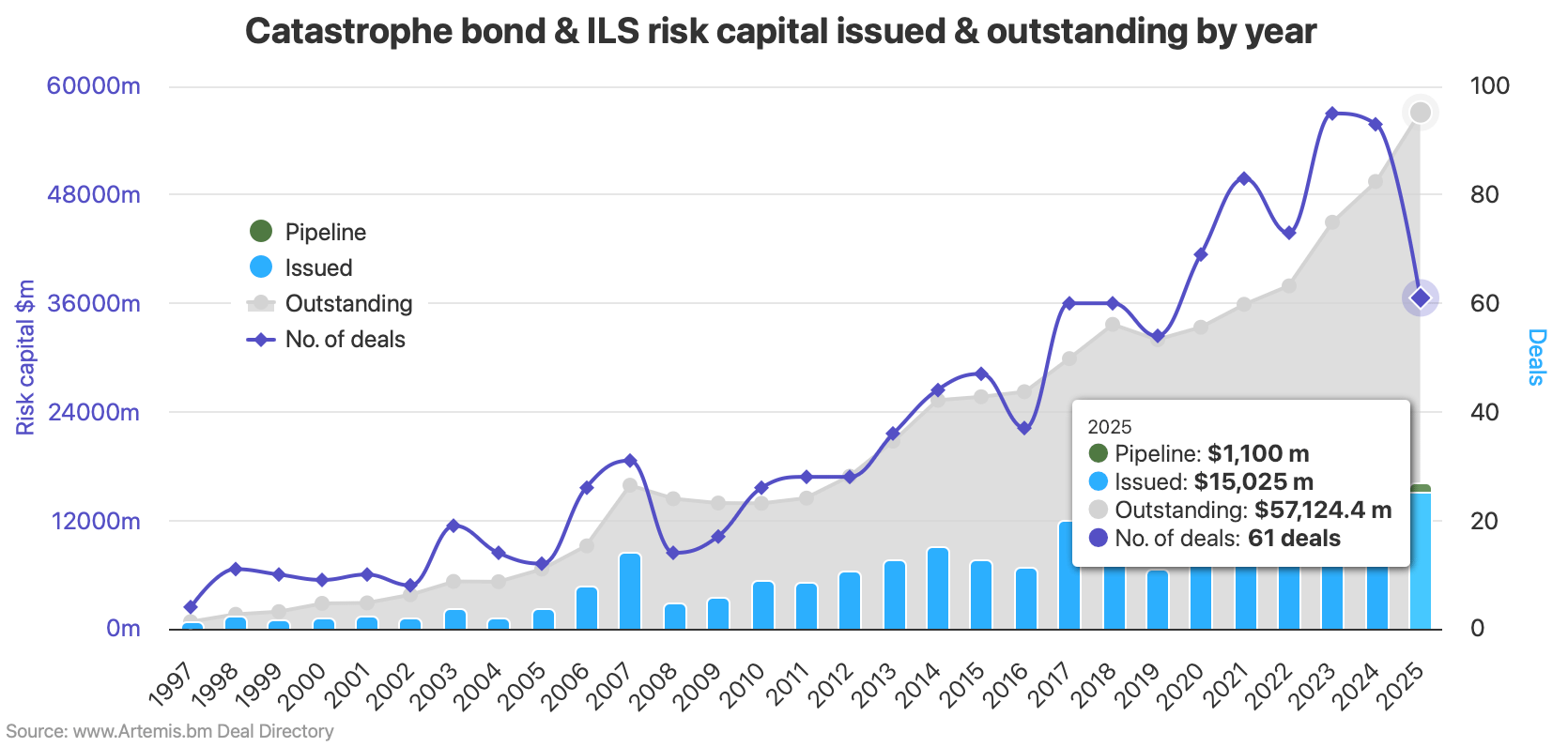

The rapid rate of catastrophe bond market activity seen in 2025 has also helped to propel the size of the market considerably higher already.

Recall that 2025 has seen the highest level of cat bond maturities ever for the first-half, but the market has outpaced that with new issuance, to grow by around 15.5% since the end of 2024.

View risk capital issued and outstanding by year in the chart below (click for the interactive version).

Artemis’ measure for the outstanding cat bond market, which does include some private deals and also may not factor in all principal reductions, or extensions of maturity, as we don’t always receive that data, has now reached just over $57.12 billion.

Which, as we said, represents 15.5% growth in the outstanding catastrophe bond market since December 31st 2024, when the total stood at just under $49.48 billion.

It is another record size for the cat bond market, although some shrinkage is to be expected before the middle of the year as there are still around $2.9 billion of maturities to roll-off risk before the end of Q2.

But the pipeline is currently projecting at least $1.1 billion of new cat bond issuance to settle before the end of June, meaning our latest projection for first-half cat bond issuance for 2025 is currently $16.125 billion.

That could, of course, rise further with any additional deals, upsizing, or private cat bonds that come to light before June 30th.

We’ve seen more first-time cat bond sponsors come to market in H1 2025 than any other half-year so far, which has helped to propel this market expansion and growth.

Alongside that, repeat sponsors have been issuing larger deals and growing cat bond’s share of their reinsurance towers, in some cases, while other sponsors have seen an increased need for reinsurance and grown their cat bond coverage proportionally with that.

We haven’t seen any particularly meaningful expansion of diversification options though, meaning the cat bond market remains US focused, in peril terms, with US wind still by far the largest component.

But, as the catastrophe bond market once again demonstrates the efficiency of its capital in 2025, it will be interesting to see if that can encourage more sponsors from other regions later this year, or perhaps more diversifying peril class deals to come to market.

The catastrophe bond market is well on-course to break the annual issuance record in 2025, as a reminder that stood at almost $17.7 billion by our numbers for 2024.

Whether it is broken will depend on loss activity through the wind season, any other particularly impactful catastrophe losses, or if some kind of disruption to capital markets occurs.

However, with only just under $1.6 billion of additional issuance needed to come to market, beyond what we have seen already and what is scheduled in the pipeline for June, it is now hard to think the annual record won’t be broken in 2025.

Stay tuned to Artemis for critical catastrophe bond market insights as the rest of 2025 progresses!

Don’t forget, you can track catastrophe bond issuance and the pipeline of deals due to settle in this chart.

You can track settled cat bond issuance by month and quarter in this chart (use the key of months at the bottom to include and exclude any from your analysis).

The Artemis Deal Directory lists all catastrophe bond and related transactions completed since the market was formed in the late 1990’s. The directory also lists the cat bonds waiting to settle, which are highlighted in green at the top of the list.

Download our free quarterly catastrophe bond market reports.

We track catastrophe bond and related ILS issuance data, the most prolific sponsors in the market, most active structuring and bookrunning banks and brokers, which risk modellers feature in cat bonds most frequently, plus much more.

Find all of our charts and data here, or via the Artemis Dashboard which provides a handy one-page view of cat bond market metrics.

All of these charts and visualisations are updated as soon as a new cat bond issuance is completed, or as older issuances mature.