- Bitcoin price breaks above its key resistance level on Monday after facing multiple rejections the previous week.

- US Spot Bitcoin ETF recorded a mild inflow of $15.85 million last week.

- Texas Senate Bill 21 aims to establish a Strategic Bitcoin Reserve, with the Texas House set to debate it on Wednesday.

Bitcoin (BTC) price breaks and trades above its key resistance level of $85,000 at the time of writing on Monday after facing multiple rejections the previous week. Institutional demand shows mild recovery, as it recorded nearly $16 million inflow into Bitcoin spot Exchange Traded Funds (ETFs) last week. Moreover, the Texas Senate Bill 21 aims to establish a Strategic Bitcoin Reserve, with the Texas House set to debate it on Wednesday.

Texas Senate Bill 21 to be discussed on Wednesday

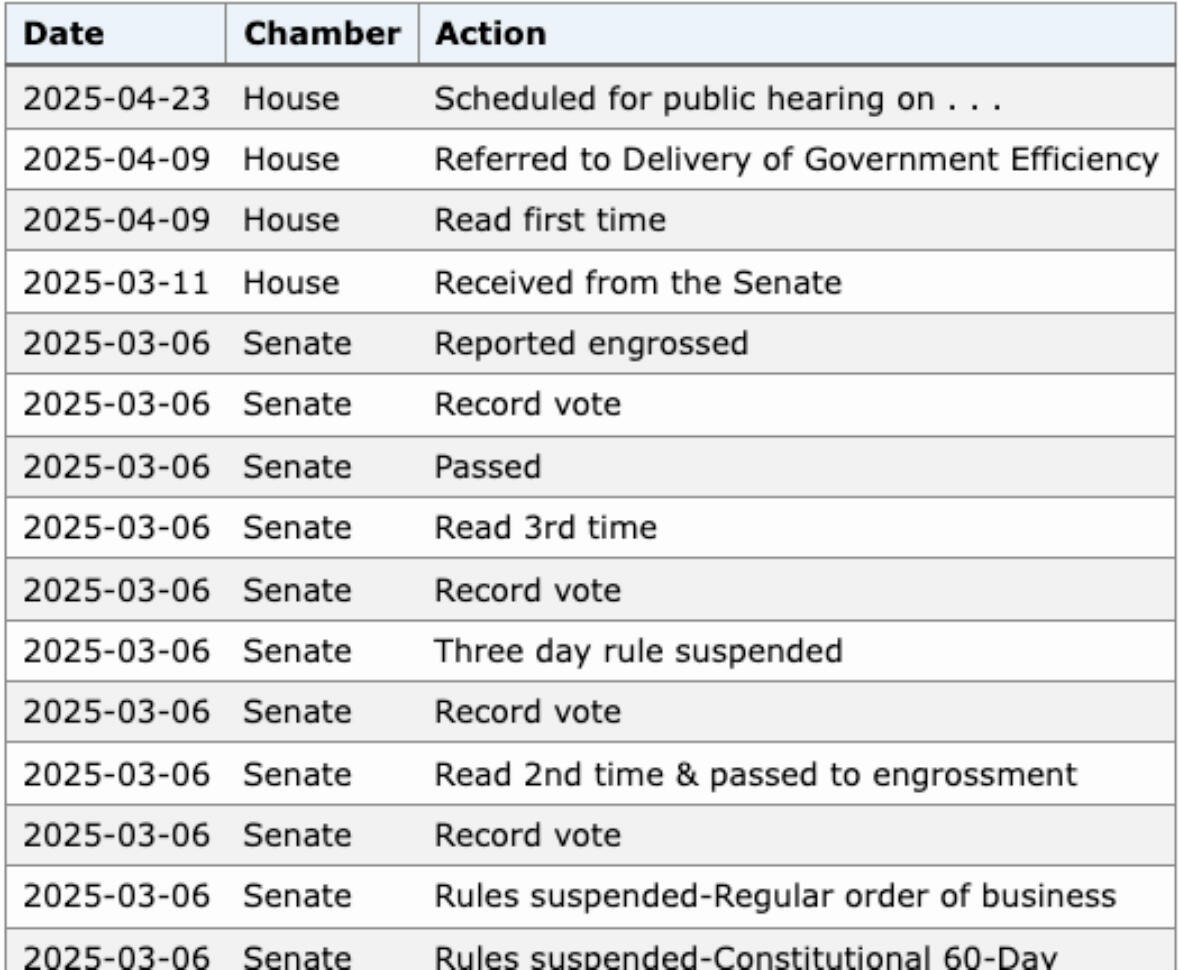

Texas Senate Bill 21 (SB 21), introduced by Senator Charles Schwertner and passed by the Senate on March 6, aims to establish a Strategic Bitcoin Reserve. The Texas House is set to debate it on Wednesday.

The Texas Comptroller administers the Texas Bitcoin Reserve. The press release states, “The fund will contain Bitcoin and other cryptocurrency with a market capitalization of at least $500 billion. SB 21 also authorizes appropriations into the newly created fund and can be funded through the budget.”

It continued: “SB 21 also creates a Strategic Bitcoin Reserve Advisory Committee to provide guidance and recommendations for administering the reserve. Additionally, a biennial report will be required to detail the reserve’s holdings.”

The legislation aligns with a broader US trend, as states such as Oklahoma, Arizona, and New Mexico explore similar Bitcoin Reserve Strategies amid federal discussions on cryptocurrencies.

The outcome of Wednesday’s House debate will be a critical next step in determining whether Texas will become the first US state to hold Bitcoin as a reserve asset.

Institutional demand shows mild recovery

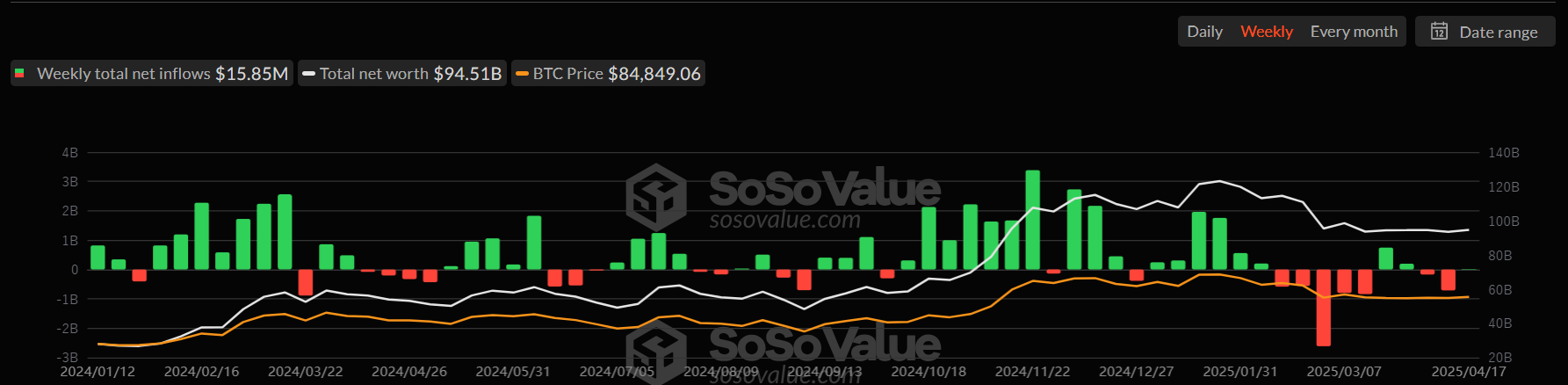

Institutional demand showed a slight recovery last week. According to the SoSoValue data, the US spot Bitcoin ETF recorded a net inflow of $15.85 million last week after an outflow of $713.30 million the previous week. These inflows are quite small compared to the inflows seen during early November. For Bitcoin’s price to recover further, the demand from institutional investors should rise and intensify.

Total Bitcoin Spot ETFs weekly chart. Source: SoSoValue

On Monday, Japanese investment firm Metaplanet announced that it has purchased an additional 330 BTC for $28.2 million at an average price of $85,605 per Bitcoin. The firm currently holds 4,855 BTC, acquired for $414.5 million at an average price of $85,386 per BTC.

Investment firms’ buying is generally bullish for Bitcoin’s price, driven by increased demand, reduced circulation, and positive market sentiment. If this trend continues, Bitcoin is likely to experience more stable price growth over the long term; however, short-term fluctuations are expected to persist as the market adjusts to this new wave of institutional involvement.

Bitcoin Price Forecast: BTC finally breaks out of $85,000

Bitcoin price has faced multiple rejections around its 200-day Exponential Moving Average (EMA) at $85,000 since April 13. At the beginning of this week, BTC finally broke above this resistance level and now trades around $87,000.

If BTC continues its upward momentum, it could extend the rally to the key psychological level of $90,000. A successful close above this level could extend an additional rally to test its March 2 high of $95,000.

The Relative Strength Index (RSI) on the daily chart reads 57 and points upward, indicating increasing bullish momentum.

BTC/USDT daily chart

On the contrary, if BTC declines, it could find support around its key level of $85,000.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin’s market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.