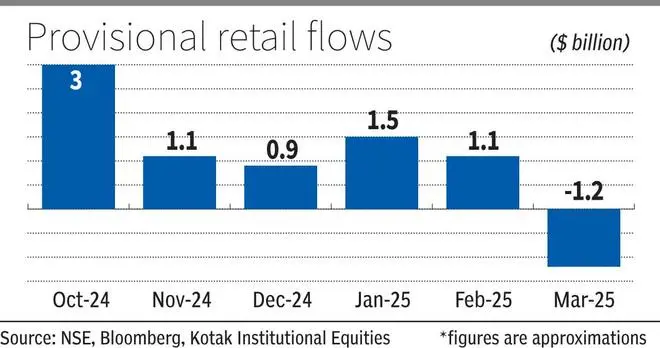

Retail flows in direct equities have turned negative in the month of March, with several investors choosing to book profits or cut their losses after five straight months of market fall.

Investors have sold shares worth nearly ₹10,000 crore during the month, showed provisional data. This is in stark contrast to retail flows in mutual funds, which have held up despite market volatility. Inflows into mutual funds through monthly systematic investment plans stood at over ₹25,000 crore in February even as market sell-off intensified.

“Some sort of fear factor has crept in,” said Deepak Jasani, an analyst. “After a long time, people started giving up hope and felt that the markets would not revive in a hurry. So, they may have tried to book whatever little profit they had on their portfolios or cut their losses.”

The Nifty slid over 15 per cent between September 26 and February-end.

Tax concerns

The other factor that may have played on the minds of investors is tax harvesting. Those sitting on losses may have sold those shares to offset the losses against capital gains on other shares this fiscal, said Jasani.

Long-term capital losses can only be set off against long-term capital gains. Short-term capital losses can be set off against long-term and short-term capital gains.

Investors should learn from the recent correction, said G Chokkalingam, Founder & MD of Equinomics Research. Several investors have been chasing momentum stocks or recently listed stocks, with high PEG ratios. For example, if the stock PE is 60 and the profit growth is not even 30, such stocks should be avoided, he said.

“Bubbles invariably build up in terms of thematic stories. This time a lot of themes have played out – new age companies, renewables, digital and microfinance,” said Chokkalingam.

According to him, there are a lot of small and mid-cap stocks that are still over-valued. Investors need to exercise caution and track the valuation, management and balance sheet quality as well as the durability of the business before investing.