Highlights:

- Stablecoins are likely to be characterized as general intangibles under the UCC of non-Article 12 states.

- To the extent that non-Article 12 UCC applies to characterizing stablecoins in a transaction, upstream security interests may continue to attach to stablecoins received downstream and make them vulnerable to upstream creditors.

- Characterization of stablecoins as CERs under Article 12 provides take-free rights, which better align with transacting parties’ expectations.

- Parties should consider structuring transactions to take advantage of Article 12 if possible. Tokenization platforms should consider implementing Article 12 mechanisms natively.

When you get change for a twenty at the gas station, you don’t expect that some unknown person has a claim on those bills and coins. When you make an electronic transfer from your checking account to pay a bill, the recipient of the funds expects the same. Parties expect such funds to be free and clear.

Under the Uniform Commercial Code (“UCC”), that’s true of “money” (as defined). Money has the privilege of “take-free” rights.[1] However, stablecoins are not “money” under the UCC.[2] If parties use stablecoins as currency in a blockchain transaction, that assumption of a take-free right may not be true. Someone else might have a security interest in the tokens you receive in your wallet. And that is a potentially big problem for transactions conducted on blockchains.

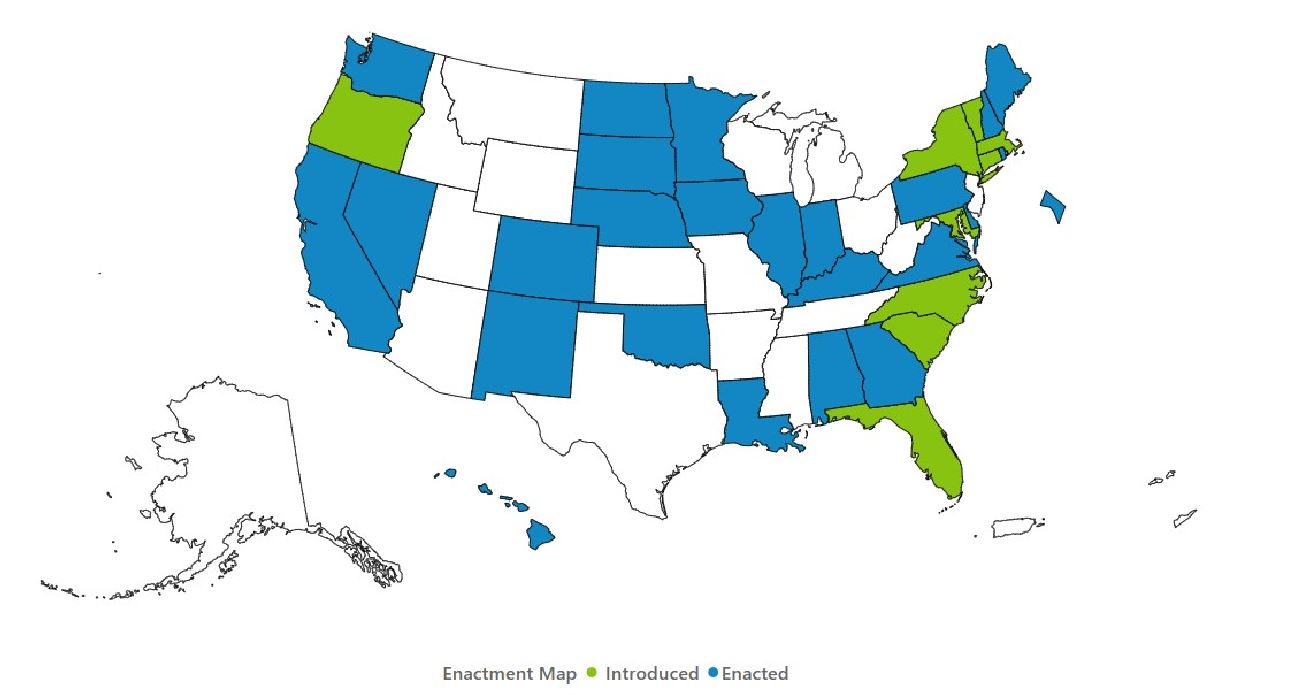

The trouble arises from the incomplete adoption of Article 12 and the 2022 UCC Amendments[3] by US states. As of this writing, 25 jurisdictions have enacted the amendments and 9 states have introduced legislation to do so.

Source: Uniform Laws Commission

This patchwork map introduces knotty choice of law issues in applying the UCC to digital assets.

New Article 12 of the UCC and the other changes included in the 2022 Amendments are designed to impart greater precision and certainty to digital assets—and they do. The signal innovation of Article 12 is the creation of the controllable electronic record (“CER”). CERs are, in essence, electronic records that can be subjected to a specially-defined type of control.[4]

CERs are a species of general intangible, but one to which the 2022 Amendments impart special rights—notably for this discussion, a take-free right available to “qualifying purchasers.” (A qualifying purchaser is a purchaser that obtains control of the CER for value, in good faith, and without notice of a claim of a property right in the CER).[5]

Stablecoins, as well as other digital tokens, are likely to be characterized as CERs under Article 12 (although the UCC analysis is not necessarily so simple or reflexive[6]). As such, qualifying purchasers of stablecoins might get take-free rights in their stablecoins, if the relevant UCC applicable to the transaction has been amended for Article 12.

Under the pre-2022 Amendment UCC, however, stablecoins and other digital tokens are just garden-variety general intangibles. The general rule under the UCC (both pre- and post-2022 Amendments) is that perfected security interests that are attached to general intangibles in the hands of a transferor continue in those general intangibles in the hands of a transferee.[7]

Stablecoins are attractive for use as an on-chain currency precisely because they are a simple[8] and understandable stand-in for fiat—indeed, their insulation from the wild volatility of other crypto has made stablecoins the “killer app” of on-chain financial transactions. But transaction parties may well not recognize that, unlike UCC “money”, the stablecoins they receive in a transaction might theoretically be encumbered.

The mischief this can create can be illustrated with a simple hypothetical. Let’s say that Party A has a secured credit facility under which it has granted to Lender A a perfect lien on all of its assets—including all general intangibles. Let’s say that Party A and a Party B engage in a blockchain transaction in which Party A transfers stablecoins to Party B. Party B then in turn transfers the stablecoins to a Party C.

And finally, let’s assume that Party A, Lender A, Party B and Party C are all LLC’s organized in non-Article 12 jurisdictions (Texas, say), and that all the documents applicable to the situation are governed by the law of a non-Article 12 state and choose forum as that non-Article 12 state (New York, say). Would Lender A’s security interest continue in the stablecoins that are now in Party C’s hands?

A New York court would likely find that, under the basic rules of the pre-2022 Amendment UCC, the answer would be yes. First, the court would likely characterize the stablecoins as general intangibles.[9] Second, the court might look at the “debtor’s jurisdiction” of Party C and conclude that it is Texas—a pre-2022 Amendments UCC jurisdiction.[10] Applying that law, the court would conclude that pre-2022 Amendments UCC rules would apply. The general rule under UCC §9-315[11] would seem to say that Lender A’s security interest would continue in the stablecoins in Party C’s hands.

So what would happen if Party A defaults on its loan, or files bankruptcy? Party C may well get a knock on the door from Lender A or the bankruptcy trustee, politely suggesting that the stablecoins in Party C’s wallet are Lender A’s collateral, and that they’d like them back.[12]

Party C would have been well advised to run UCC searches against Party B and Party A, checking for liens against general intangibles. But the feasibility of doing so assumes that Party C had the needed information—and if the parties only had identified themselves to each other by hexadecimal public blockchain addresses, running a UCC search may not have been possible.

If we vary the hypothetical, however, and make Party C a Delaware LLC and the chosen law and forum for all documents Delaware, the situation changes. Delaware has adopted Article 12 and the 2022 Amendments. The Delaware court would look to Delaware as the debtor’s location of Party C, and apply Delaware’s rules for perfection, effect of perfection and priority. Assuming that the stablecoins were characterized using Delaware’s UCC rules—that is, as probably constituting CERs[13]—and assuming that Party C is a qualifying purchaser, then under the Delaware UCC Party C would have a good case that it takes the stablecoins free of any property interest, including Lender A’s security interest.[14]

Article 12 is still very new and untested. It is possible that the preceding analysis might turn out differently in actual cases—and smart UCC lawyers might differ with aspects of my thinking and reach different conclusions. At the very least, though, these are conversations we should be having.

UCC choice of law may seem like a dry and academic subject. However, parties engaging with digital assets like stablecoins (whether parties to deals executed on blockchains, tokenization protocols or DeFi platforms) might suddenly find it all too exciting.

The incomplete state of adoption of the 2022 Amendments creates a situation where the application of divergent state UCC’s can potentially have wildly different results for transaction parties. At least until the “Uniform” Commercial Code is once again uniform, transaction parties should seek to structure their deals to minimize these risks, and tokenized RWA-leaning projects (like specialized RWA L-1’s and DeFi protocols) might consider natively implementing solutions to help deal with them.

Much time, effort and money is expended by blockchain participants on other security issues—like cyberattack vulnerability and smart contract risk. If a deal or a protocol is blown up because deadbeat upstream holders put liens on tokens, the parties that deal or developers of that protocol might ask themselves why they didn’t also consider Article 12 structuring to mitigate these UCC risks.

[1] See UCC §§ 9-332(a) (take free right of transferee of tangible money), (b) (take free right of transferee of funds from a deposit account). Unless otherwise indicated, references to the UCC are to the UCC as amended by the 2022 Amendments.

[2] See “Mo’ Money Mo’ Problems: More on the Changes to the UCC’s Definitions of Money – UCC 9-102(a)(54A) – Part Four”, Cadwalader Cabinet News (Dec. 5, 2024) https://www.cadwalader.com/fin-news/index.php?eid=845&nid=115&search=money

[3] Uniform Law Commission, American Law Institute, Uniform Commercial Code Amendments (2022) (2022).

[4] UCC §12-102(a)(1).

[5] UCC §12-102(a)(2).

[6] I consider some of the issues with UCC characterization of digital tokens here: “Tokenized Assets as Collateral—You Need to Look Inside.” https://www.linkedin.com/posts/christopher-mcdermott-9bb18714_tokenization-tokenizedsecurities-tokenizedassets-activity-7256685087562305536-d2wP?utm_source=share&utm_medium=member_desktop&rcm=ACoAAALfiN8BRUh_zEuGlCMZeQ4l2OjaaflPN-U

Stablecoins might, for example, be characterized under Article 12 as “controllable payment intangibles”, although the analysis in that case might be similar as for CERs.

[7] UCC §9-201(a) (security agreement effective against purchasers of collateral and against creditors); UCC §9-315(a)(1) (security interest continues in collateral notwithstanding disposition). (Note that continuity of perfection of a security interest in stablecoins constituting proceeds would be subject to other rules in UCC §9-315.)

[8] Of course, stablecoins may not in fact be so simple, for many reasons. I recently ruminated on some of those reasons (inconclusively). “Can Your Grandma Buy Undies With USDC? And Other Important UCC Questions About the Blue Stablecoin,” (Paragraph: https://paragraph.xyz/@article12man/can-your-grandma-buy-undies-with-usdc?referrer=0xD5A8045b065153c1F961152E9c193fCDF77d7dEd LinkedIn: https://www.linkedin.com/posts/christopher-mcdermott-9bb18714_can-your-grandma-buy-undies-with-usdc-activity-7276071025941917696-n2vJ?utm_source=share&utm_medium=member_desktop&rcm=ACoAAALfiN8BRUh_zEuGlCMZeQ4l2OjaaflPN-U )

[9] I made the hypothetical easy by assuming all potentially applicable UCC’s are pre-2022 Amendment UCC’s. Whether the stablecoins would be characterized as CERs if the transaction straddled both Article 12 UCC jurisdictions and non-Article 12 UCC jurisdictions is an excellent question—and one to which I do not offer an answer here.

[10] See NY UCC §9-301(a).

[11] “Except as otherwise provided in this article and in Section 2–403(2):

(1) a security interest or agricultural lien continues in collateral notwithstanding sale, lease, license, exchange, or other disposition thereof unless the secured party authorized the disposition free of the security interest or agricultural lien; and

(2) a security interest attaches to any identifiable proceeds of collateral.”

NY UCC §9-315(a).

[12] The transparency of blockchain transactions may even make it easier for Lender A or the trustee to track down Party C.

[13] See footnote 9 above.

[14] “Rights of qualifying purchaser. — A qualifying purchaser acquires its rights in the controllable electronic record free of a claim of a property right in the controllable electronic record.” Del. UCC §12-104(e).