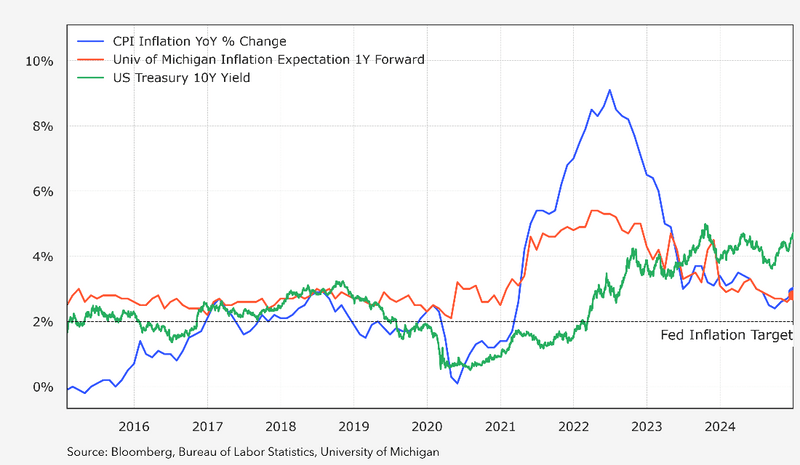

Figure 1: US CPI Inflation and Inflation Expectations

The persistence of inflation, despite higher central bank policy rates, reminds investors of the structural regime shift afoot. While the 2000-2020 low inflation era benefited from globalization and favorable demographics, these forces are now reversing. U.S.-China decoupling, aging populations, and sustained above-trend growth point to a more inflationary future. The COVID pandemic (and the attendant macro and geopolitical changes) appears to have ushered in a new era of “(modestly) higher for longer”, where nominal growth, labor productivity, inflation, and interest rates will all be (modestly) higher than in the disinflationary period post-2008. While we are unlikely to see a repeat of the 1970s style inflation, inflation is unlikely to return to the sub-2% level irrespective of the interventions by the Federal Reserve, which is only one actor in the multi-faceted macro tapestry.

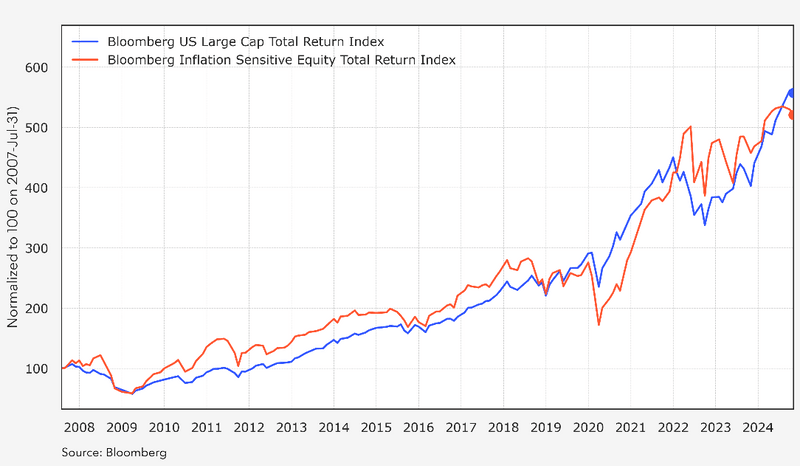

Figure 2: Long Run Performance of Bloomberg Inflation Sensitive Equity Index

Systematic inflation sensitive equities

This new era calls for a rethinking of investors’ approach to asset allocation. The structural shifts in the economy present new challenges for risk assets as well as new opportunities. Whereas higher inflation and interest rates hurt asset value, higher productivity and higher real growth boost corporate earnings and profitability. The latter is especially true for stocks with strong pricing power or stocks with a tilt toward inflation, which may provide a better way to navigate the new macro environment. In response to the new macro landscape, Bloomberg launched the Bloomberg Inflation Sensitive Equity Index (BINFLST) in 2022, designed to identify stocks most responsive to inflation dynamics. (Figure 2)

The index construction methodology is fully systematic: starting with the Bloomberg US 3000 Index (B3000) universe, the index focuses on four inflation-relevant sectors—Energy, Industrials, Materials, and Real Estate. Stocks within these sectors are then selected based on two key criteria: the combined rank of their “inflation betas” (measured by regressing stock returns against commodity returns and changes in inflation breakevens) and their free cash flow yields. The index is equal weighted. The sector tilt and equal weighted construction can help investors diversify from the market benchmark, which has become increasingly top heavy and dominated by growth tech stocks.

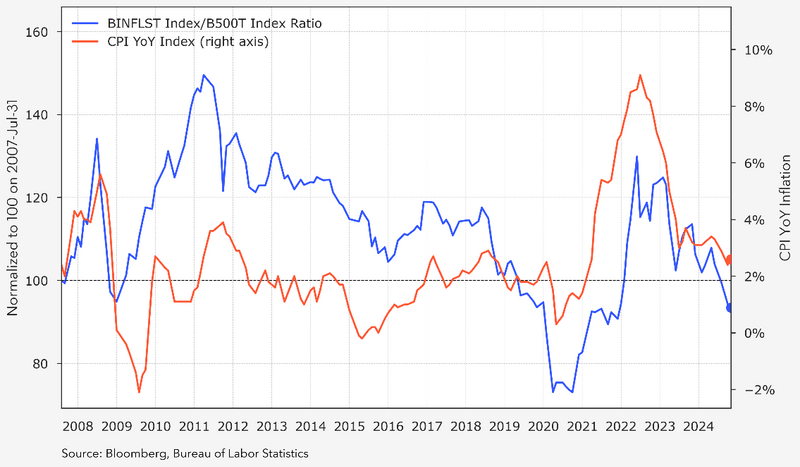

Figures 2 and 3 illustrate the performance characteristics of the Bloomberg Inflation Sensitive Equity Index (BINFLST). Figure 2 compares its absolute performance against the Bloomberg US Large Cap Index (B500), while Figure 3 displays relative performance and confirms the intended objective of the index: BINFLST relative performance has closely tracked year-over-year changes in headline CPI.

Figure 3: Relative Performance of Inflation Sensitive Equities Closely Tracks CPI

There are a couple myths about inflation sensitive equities that should be corrected. Many investors casually assume that 1) inflation sensitive stocks are simply energy stocks; 2) since inflation sensitive stocks tend not to be technology or growth stocks that they have consistently and significantly underperformed the broader US stock market over the past 20 years and missed out one of the greatest bull runs. It turns out neither is true.

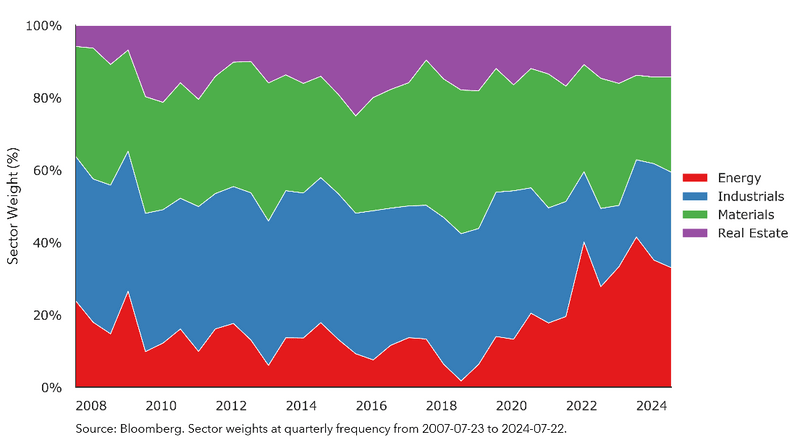

Figure 4: Sector Composition of the Bloomberg Inflation Sensitive Equity Index

Regarding the first popular presumption, while there is a certainly a significant allocation to energy stocks, especially in the last few years since 2020 likely driven by energy sector’s strong free cash flows, inflation sensitive equities are by no means exclusively or primarily just oil stocks. As Figure 4 shows, the majority of the BINFLST index weight has historically been attributable to industrial, materials and real estate sectors.

The falsity of the second presumption about inflation sensitive equities may surprise investors even more than the first. Between 2007 and today, which has been a historically unusually lowflationary environment, in which growth stocks, particularly technology stocks, have absolutely roared, inflation sensitive equities have in fact kept up very well with the broader US stock market returns and at various times strongly outperformed the broader market.

Merits of expanding beyond energy for inflation protection

The traditional association between energy stocks and inflation is well-founded. After all, energy is the universal input into everything we do and one of the most volatile components of the CPI basket. However, improvements in energy efficiency and increase in US domestic energy supply have weakened the traditional link of the energy sector to inflation and calls for the inclusion of a set of other relevant sectors.

Industrial companies can serve as effective inflation hedges through two key mechanisms: pricing power stemming from high barriers to entry, and increased demand for their products as businesses invest in automation to combat rising labor costs. The machinery and automation segments in particularly benefit from this capital expenditure cycle.

Materials companies can offer inflation protection through their direct exposure to commodity prices that often drive inflation itself. Mining companies producing copper, lithium, and rare earth elements benefit from infrastructure spending, while specialty chemical producers can typically pass through cost increases to preserve real earnings.

REITs and real estate companies can provide inflation protection through property value appreciation and the ability to adjust rents frequently, particularly in the residential sector where lease terms allow for more dynamic pricing.

The case for a diversified approach

The Bloomberg Inflation Sensitive Equity Index (BINFLST) takes a broader approach by incorporating energy, industrials, materials, and real estate. This sectoral diversification has proven effective across varying inflationary environments. As we re-enter an inflationary regime and equity valuation stands at perilously high levels, inflation sensitive equities represent a strong candidate for investors’ portfolio allocation to equities.

Visit I