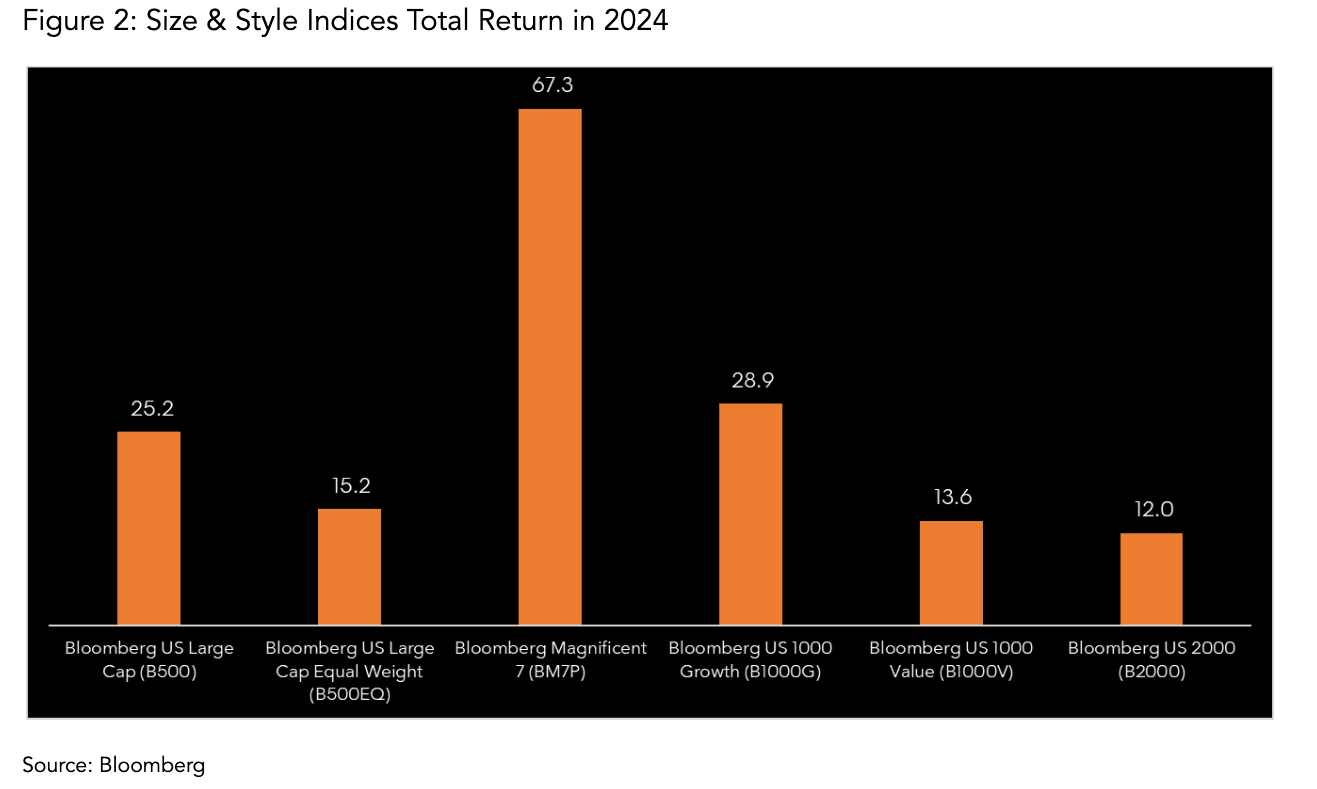

Looking across the US size and style spectrum, investors of all types had reason to celebrate. While growth (B1000G) continued to outperform value (B1000V), both styles produced double digit returns. In mega caps, the Bloomberg Magnificent 7 Index (BM7T) returned a whopping 64%. Much like in 2023, these names were a chief contributor to equity returns, as dispersion did not improve. The Bloomberg 500 Equal Weight Index (B500EQ) returned only 15%, below its 2023 tally. In a similar vein, small cap stocks (B2000) lagged last year’s return, still trailing their larger peers by a wide margin.

International equity investors had even less to celebrate. While those invested abroad may be accustomed to persistent underperformance versus US markets, the 2024 difference was sizable, as the Bloomberg Developed Markets ex-US Index (DMEU) was up only 5.5%. While US based investors may have been disappointed, an index consisting of the same constituents but hedged against dollar strength (DMXUHU) performed slightly better at 13%. The strength of the greenback was certainly a major story in 2024, with the dollar rallying throughout the year versus other major currencies.

On the thematic front, investor excitement around artificial intelligence continued to move markets. While Nvidia is the name most associated with the theme, there are other major players that have seen their price rise as well. The Bloomberg Artificial Intelligence Aggregate Index (BAIAT), which consists of names across the AI value chain, was up 35%.

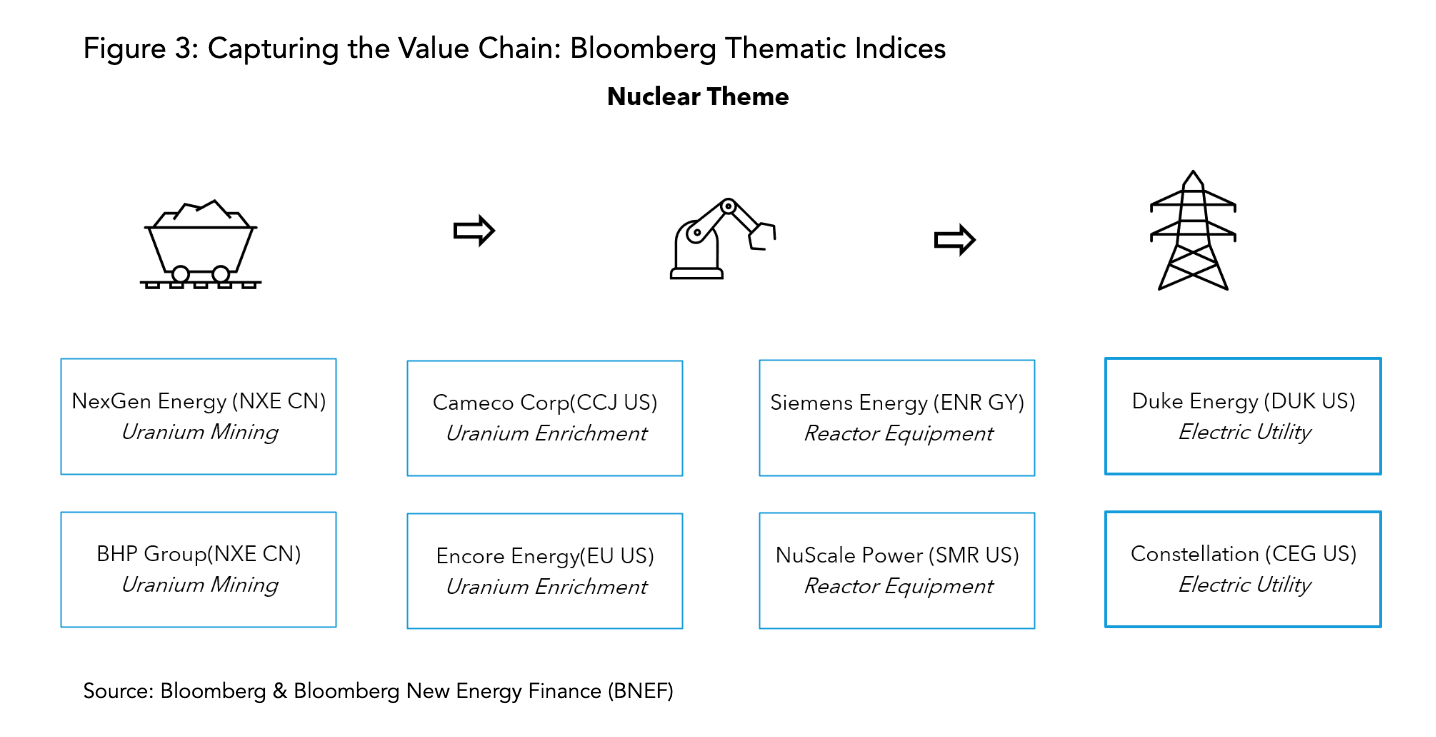

Artificial Intelligence requires large amounts of energy, and as these requirements came into greater view, names not associated with the theme gained investor interest as well. Nuclear energy has come into focus globally as a potential solution for the ever-growing energy needs of our world. The Bloomberg Nuclear Aggregate Index (BNUAT) looks across borders and sectors to identify and capture the entire nuclear value chain, holding names associated with uranium mining all the way up to electric utility companies. That index was up 32% last year.

In comparing last year’s performance to that of 2023, some might ponder whether past performance may indeed be an indication of future return. Despite this, most prognosticators would agree that 2025 will be different, with so many important questions facing investors. How high can valuations go? Will inflation continue its downward trend? What does the new administration have in store for corporate America? With so much influx, Bloomberg Equity Indices allow investors a precise means of identifying investment trends and risks, providing a measure of real-time sentiment across styles, countries, and themes.

Learn more about Bloomberg’s equity index offerings.